jersey city property tax rates

PROPERTY TAX DUE DATES. We had placed a call to the property tax.

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

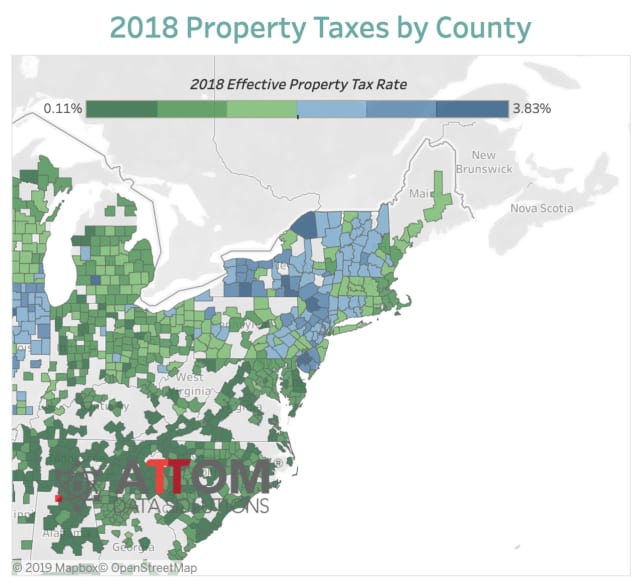

. The amount of property tax owed depends on the appraised fair market. Did South Dakota v. The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

Jersey City establishes tax levies all within the states statutory rules. 2021 Table of Equalized Valuations for all of New Jersey. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

There is no applicable county tax city tax or special tax. Property Tax Rate Published -- 148. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. The New Jersey sales tax rate is currently. The Hudson County Treasurer and Tax Collectors Office is part of the Hudson County Finance Department that encompasses all financial functions of.

The County Tax Board certified the JerseyCity tax rate today with the final rate of 148 per 100 of assessed value previous estimated rate of 162 was in letters to residents so we came in below. Table of Equalized Valuations. The 6625 sales tax rate in Jersey City consists of 6625 New Jersey state sales tax.

To pay for the City of Trenton Property taxes online you will need either your account number or the propertys block lot and Qualification if applicable and the owners last name. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252. This is the 5th year we have kept the municipal tax rate stable.

This is the total of state county and city sales tax rates. JavaScript chart by amCharts 32114. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Jersey City New Jersey 07302. The minimum combined 2022 sales tax rate for Jersey City New Jersey is. 11 rows City of Jersey City.

897 The total of all income taxes for an area including state county and local taxes. Certified October 1 2021 for use in Tax Year 2022 As amended by the. Overview of New Jersey Taxes.

The tax rate is set and certified by the Hudson County Board of Taxation. Search Any Address 2. New Jersey Tax Court on January 31 2022 for use in Tax Year 2022.

The Jersey City Tax Collector located in Jersey New Jersey is responsible for financial transactions including issuing Hudson County tax bills collecting personal and real property tax payments. 159 rows County Equalization Tables. Enter an Address to Receive a Complete Property Report with Tax Assessments More.

Get In-Depth Property Tax Data In Minutes. Real estate evaluations are undertaken by the county. Online Inquiry Payment.

Equalized tax rate in Somerdale Borough Camden County was 4083 in 2018. The General Tax Rate is used to calculate the. Get driving directions to this office.

Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. 587 rows Click here for a map with more tax rates.

Tax amount varies by county. Ad Search County Records in Your State to Find the Property Tax on Any Address. See Property Records Tax Titles Owner Info More.

Property Tax Rates Average Residential Tax Bill for Each New Jersey Town. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. Tax Rates for Jersey City NJ.

Box 2025 Jersey City NJ 07303 Checking Account Debit. Here is the list of 30 New Jersey towns with the highest property tax rates. The information displayed on this website is pulled from recent census reports and other public information sources.

Start Your Homeowner Search Today. City of Jersey City PO. Each business day By Mail - Check or money order to.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. The County sales tax rate is. Homeowners in New Jersey pay the highest property taxes of any state in the country.

The average effective property tax rate in New Jersey is 242 compared to. In Jersey City the average residential school tax in 2021 was. The Tax Collectors office is open 830 am.

10 25 50 75 100 All. 700 The total of all sales taxes for an area including state county and local taxes Income Taxes. The Jersey City sales tax rate is.

The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change. In fact rates in some areas are more than double the national average.

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

These Towns Have The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

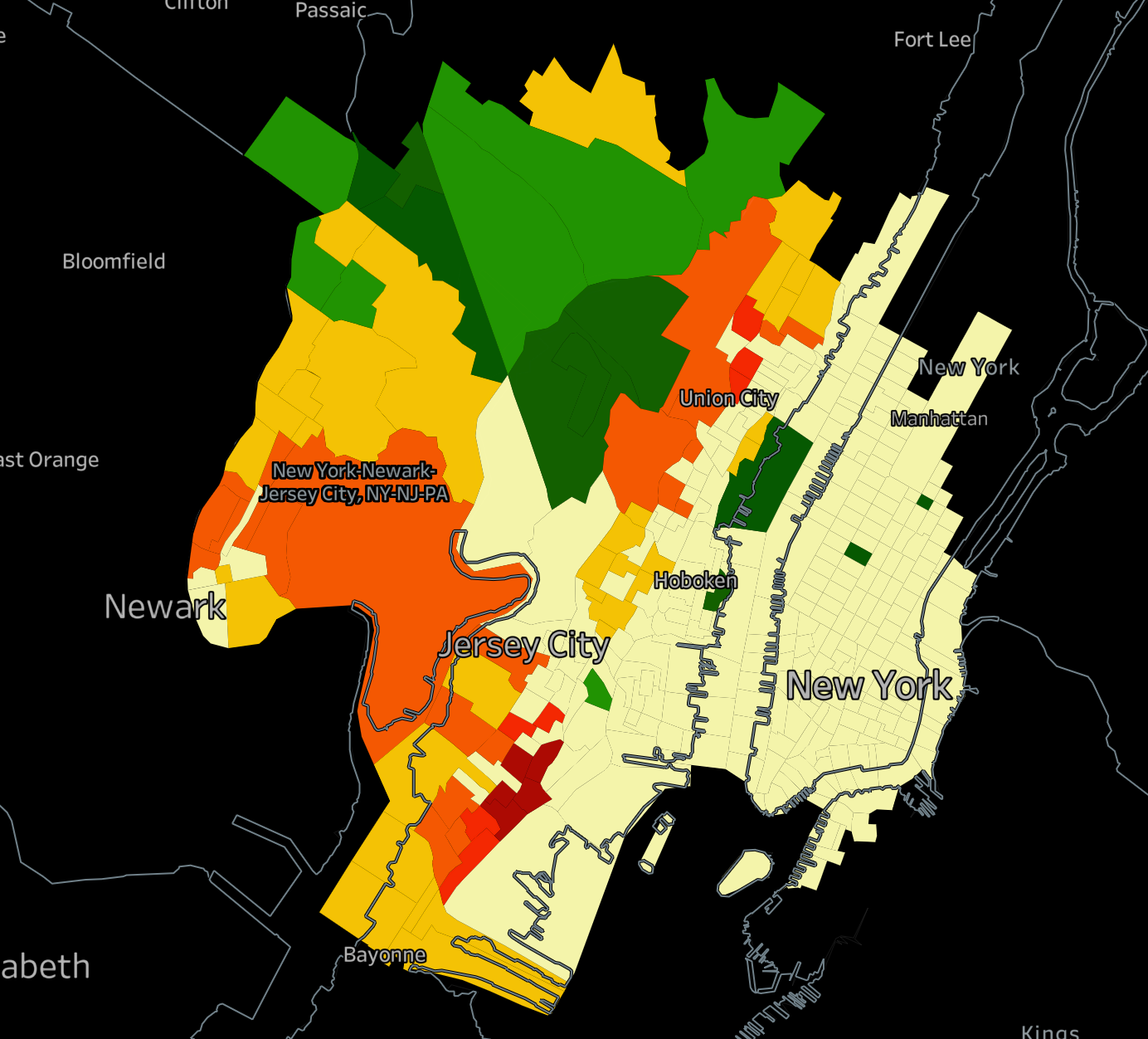

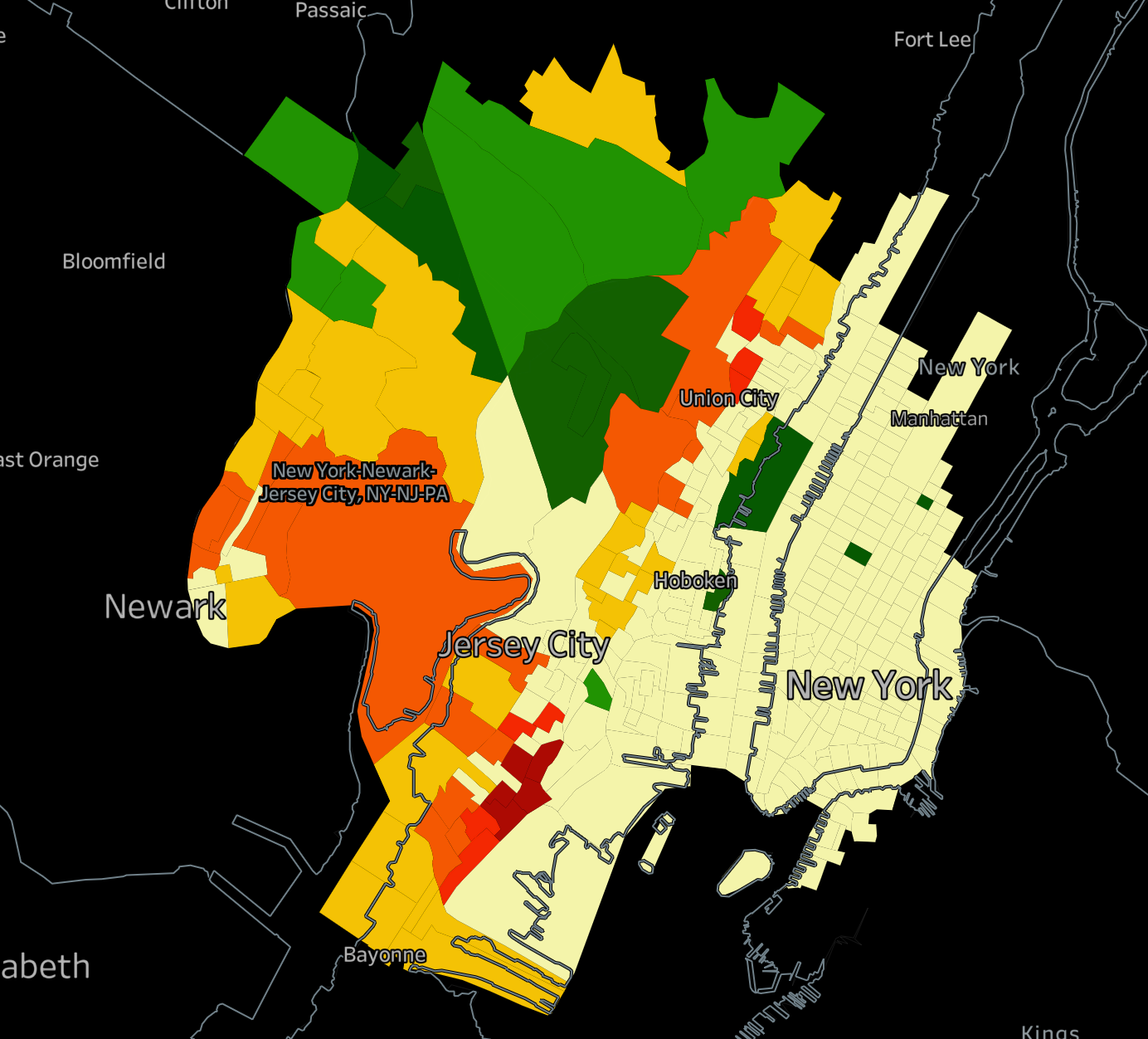

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New Jersey Real Estate Market Prices Trends Forecasts 2022

Jersey City Slams 1 600 School Tax Hike But Education Group Says Sides Need To Figure How To Make That Work Nj Com

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Jersey Real Estate Market Prices Trends Forecasts 2022

New York Property Tax Calculator 2020 Empire Center For Public Policy

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

The Jersey City Real Estate Market Stats Trends For 2022

New Jersey Sales Tax Small Business Guide Truic

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future